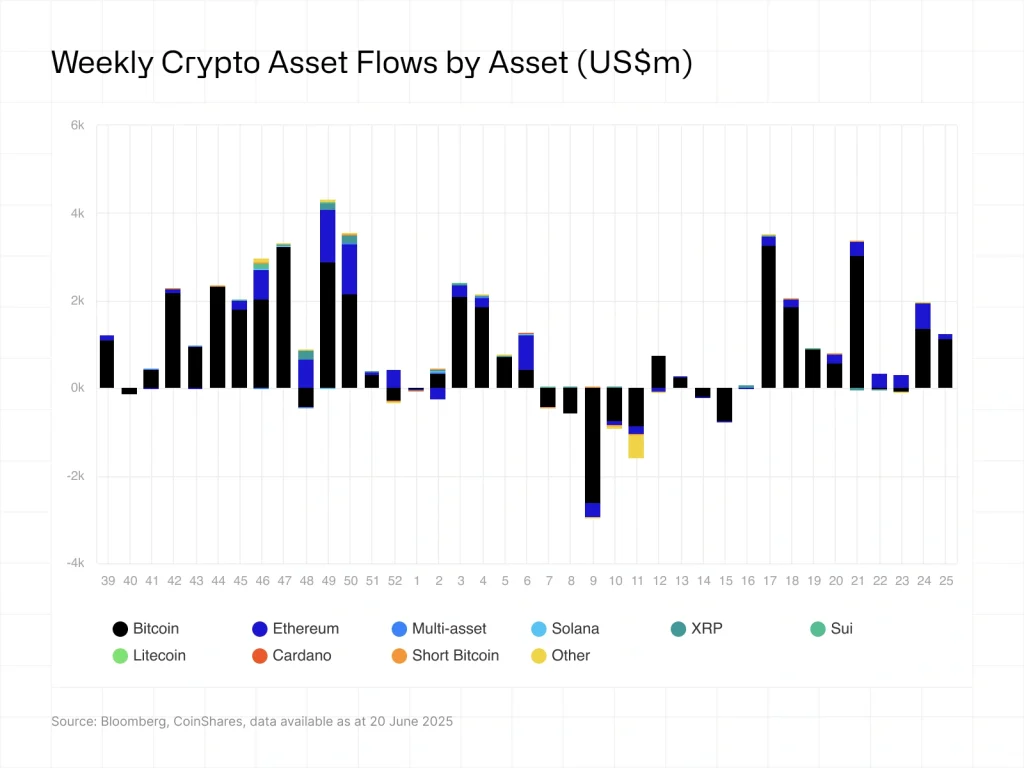

Bitcoin (BTC) demand by institutional investors has remained high amid rising fears of short-term crypto market capitulation. According to market data from CoinShares, Bitcoin’s investment product recorded the second consecutive week of cash inflow last week of about $1.1B.

As a result, the BTC’s investment products have posted a net monthly flow of about $2.38 billion and a year-to-date cash inflow of around $12.7 billion. The United States led in net cash inflows of about $1.25 billion, while Hong Kong and Switzerland posted a net cash outflow of about $32.6M and $7.7M respectively.

Is Bitcoin Price Ready for a Bullish Breakout?

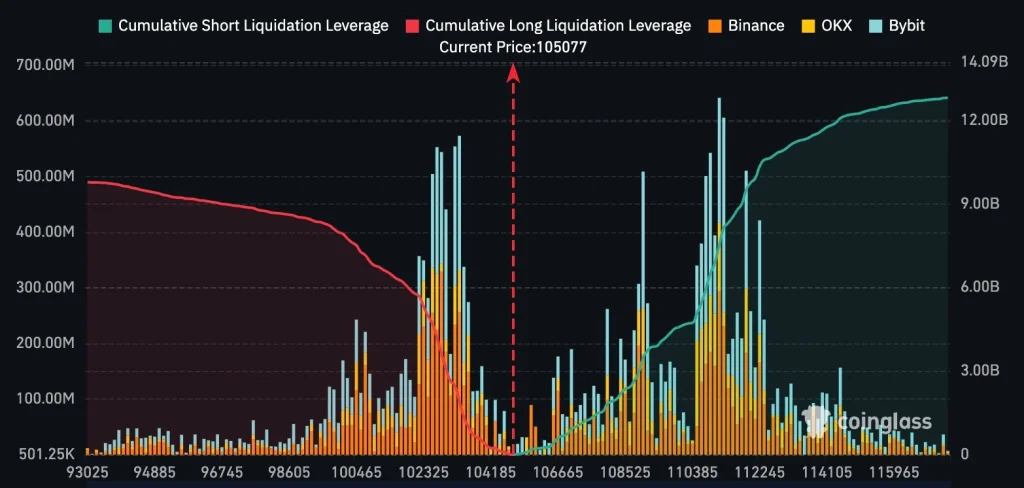

Bitcoin price has rebounded over 3 percent to trade about $104,100 on Monday, June 24, during the mid-North American trading session. The flagship coin, however, faces a significant resistance range between $110k and $112k.

In the weekly timeframe, BTC price has been forming a potential macro double top coupled with a bearish divergence of the Relative Strength Index (RSI).

With the market data from Coinglass showing more than $12 billion in cumulative short liquidation leverage, BTC price faces further bearish sentiment in the coming weeks.

As Coinpedia reported, crypto analyst Benjamin Cowen thinks that the wider crypto market, led by BTC, will record lower lows in the coming months and poten