The AVAX rate grew by 8.15% over the past week, buoyed by bullish patterns signified by the Ichimoku cloud lines, showing a possible for additional development of Avalanche. Currently, three-quarters of AVAX financiers discover themselves in the green, a substantial fact frequently preceding essential property worth motions.

This increase in market belief and technical indications fuels speculation on whether such favorable indications might push AVAX’s cost towards the $70 mark. Investors and experts alike are carefully tracking to see if this existing wave of optimism signals a transformative stage for AVAX.

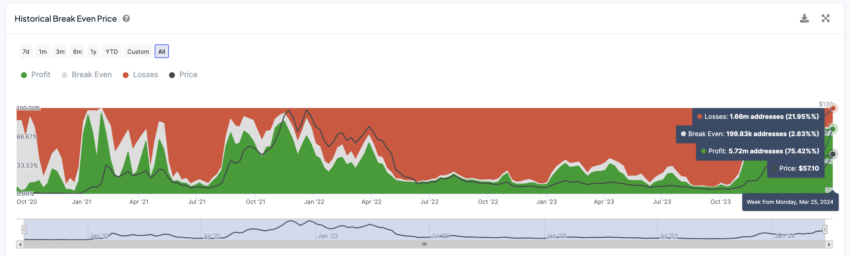

AVAX Currently Has 75% of Holders at Profit

An excellent three-quarters of AVAX holders, corresponding to some 5.72 million addresses, are now seeing revenues following a current uptick in the coin’s worth – a notable shift from the 50-60% success variety that hadactually been the standard over the preceding months.

The “Historical Break Even Price”, a crucial metric revealing the average rate at which all present holders would break even, shines a spotlight on the financialinvestment’s cumulative success. Notably, a previous climb to this 75% success limit in 2021 preceded a sharp boost in AVAX’s cost from $75 to $117 in simply 20 days.

Currently, with 21.95% of holders still in the red and AVAX trading 59.74% listedbelow its peak, the possibility increases that these financiers may hold onto their possessions in anticipation of more gains rather than offer, specifically thinkingabout the coin’s range from its historic high.

Read More: Avalanche (AVAX) Price Prediction 2024/2025/2030

Ichimoku Clouds Are Drawing a Potential Bullish Scenario

The Ichimoku analysis of AVAX exposes a reasonably bullish belief due to the cost placing above the cloud, which tends to suggest an up pattern. The cloud appears to be altering color from red to green, recommending a shift towards a bullish market as Span A increases over Span B.

The Conversion Line, which represents short-term rate momentum, is above the Base Line, a medium-term momentum indication, more validating the bullish belief for AVAX. The Lagging Span, nevertheless, is within the rate variety from 26 durations ago, showing a absence of strong momentum, as preferably, it oughtto be above the rate action for a strong bullish verification.

The Ichimoku Cloud is a technical analysis technique that paints a vibrant photo of market patterns and possible assistance or resistance locations on a chart. It integrates 5 lines that program brief to long-lasting rate action and future forecasts, forming a ‘cloud’. A rate above the cloud signals bullish conditions, while listedbelow shows bearish patterns.

The interaction of these lines likewise offers insights into market momentum and can signal capacity turnarounds or extensions of patterns. The rate action stays above the Base Line, yet it carefully follows the Conversion Line, which often can act as a veryfirst level of assistance in an uptrend.

The lack of a bearish crossover, where the Conversion Line would drop listedbelow the Base Line, keeps the bullish outlook. As revealed in the chart, the volume sign is fairly low, which might concern the strength of the existing pattern, and traders may appearance for an boost in volume to verify evenmore bullish development.

AVAX Price Prediction: Will It Reach a 2-Year High?

AVAX’s cost hasn’t reached $70 consideringthat April2022 That might occur quickly if AVAX is able to break some resistances ahead.

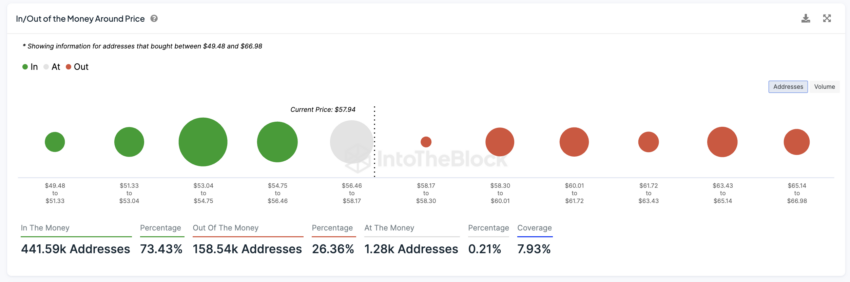

The In/Out of the Money Around Price (IOMAP) chart for Avalanche (AVAX) shows a concentration of assistance at the $53 to $54.75 rate variety, where holders gotten the biggest volume of AVAX tokens. This is showed in the existence of significant green bubbles, showing these holders are ‘in the cash’ and may act as a buffer versus cost decreases.

The IOMAP chart is a visual tool that highlights rate levels where substantial numbers of possession purchases have happened, proving capacity assistance and resistance zones based on the present cost. It highlights where holders may be making a earnings (‘in the cash’), breaking even (‘at the cash’), or experiencing a loss (‘out of the cash’).

Green locations signal big clusters of lucrative purchases, suggesting capacity assistance, while red