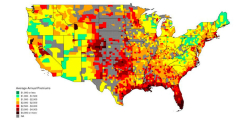

Average annual insurance premiums in the first half of 2023 by county show many counties already … [+] stressed by high premium prices.

In the midst of a wildfire roaring across southern California that is not only destroying homes but also taking lives, home insurance costs are taking on a whole new dimension.

Those fears are propagating into the way homebuyers look at new properties, into the shopping and selection process and therefore the sales process, into land development, into economic impacts and on and on.

Zillow reports that newly listed for sale homes face increasing climate risk compared to 2019 across five factors: flood, wildfire, wind, heat, and air quality. This increased risk means that more than 80% of home buyers now take climate risks into consideration when shopping for a new home.

In November 2024, Zillow looked at new listings of existing homes to quantify current risks. Nearly two-thirds (61.6%) have a major risk of extreme heat and more than a third (38.6%) are at major risk of extreme wind exposure. Data partner First Street also reports that 17% are at major wildfire risk, 15% have a major risk of flooding, and 11% are exposed to a major air quality risk.

More than 60% of new listings across the country were at risk for extreme heat, reaching above 90% in more than 25 of the largest metro areas. In most large population centers across the west coast, the risk of poor air quality affects a majority of listings—from 73% in Los Angeles to 98% in San Jose.

The number of U.S. single family homes at risk for a flood or wildfire has been climbing year over … [+] year and impacts all income levels.

In another study from climate risk intelligence group DeltaTerra Capital, the amount of single family homes in the U.S. at high risk for flood was calculated at more than five million, and homes at high risk for wildfire exceeds four million.

Susan Crawford, senior fellow in the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace, just published the paper “Flood Insurance Reform for the U.S. Housing and Mortgage Market” that offers proposals on insurance and mortgages for a more resilient housing market.

During a recent press conference, Crawford shared insights and policy suggestions from the paper alongside Benjamin Keys, professor of real estate and finance at The Wharton School of the University of Pennsylvania.

“The pace of climate change and the disasters are so much more rapid than policymakers are able to react,” he said. “The severity is outpacing what we can handle as a country with what we build and the policies that we make. We went from 3 per year in the 1970s, and last year there were 27 climate events. We are in an entirely different world when it comes to climate induced disasters.”

Home Insurance Costs Have Wide Impacts

Increased costs to protect homes is estimated to bring down property value by trillions of dollars.

While climate risks like extreme heat affect an area’s livability, wildfire, flood and wind risk are more likely to impact a homeowner’s ability to find or afford home insurance. Paired with the current housing affordability crisis, the cost of insurance could be the difference between a buyer being able to afford a home and not.

While homeowners and builders are desperate for the right solutions, new solutions may be slipping further away. Investments in climate tech went from $127 billion in 2022 down to an estimated $43 billion in 2024, according to BloombergNEF.

While that is evidence that direct investments are fading away, current investments also are facing challenges. The current wildfires are impacting the stock market. California’s utility company’s shares are down 14% from the start of the year, impacted insurance companies’ stocks are falling, and state funding for firefighting and emergency resources are stressed.

As David Burt, the founder and CEO of DeltaTerra Capital, pointed out in the recent press conference, insurers will be scrambling to pay out premiums and raising prices to do that, creating broad, devastating impacts for homeowners.

“If insurance costs will go up 1% per year and the yield on assets is 5%, then it takes 20% off the value of the property,” he said.

Keys’s recent paper, “Property Insurance and Disaster Risk: New Evidence from Mortgage Escrow Data,” shows that insurance premiums increased 33% from 2020 to 2023. The paper also demonstrates the causes and impacts of rising reinsurance that is passed through to homeowners. The paper projects that this reinsurance shock could result in annual premiums going up $700 by 2053.

It’s a vicious circle. Rising insurance costs are driving down property valuations for properties that are leveraged without the